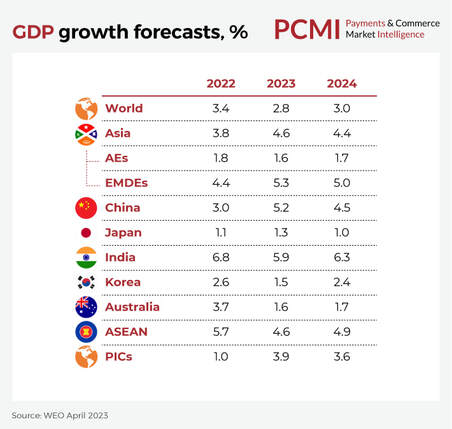

Other economies in the region are projected to experience solid growth as well (Asian emerging market and developing economies: 5.3% and advanced economies 1.8%). Overall, Asia-Pacific economies are expected to contribute about 70% of global growth in 2023.[1] For these reasons, APAC has recently been described by the IMF as a “bright spot in a slowing global economy.”

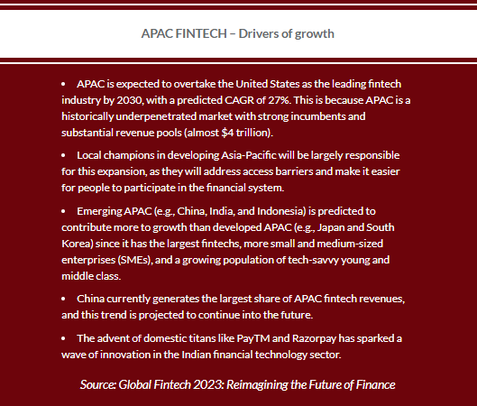

Being home to 60 percent of the world’s population[3] (4.3 billion people) and including the world’s most populous countries (China and India), one of APAC’s comparative advantages is that it has one of the largest fintech user bases globally, with growing fintech adoption.

This adoption varies across the region, with developing markets showing deeper penetration than developed ones. China is by far the leader, at 87% fintech adoption (use one or more fintech services[4]), with India, not far behind. Developing markets show 70% more finance app installs than developed markets. Indonesia, the Philippines, Thailand, and Vietnam saw the most demand growth in fintech app services in 2018-2021[5]. In developed markets we see slightly lower (but still high) adoption, where traditional bank penetration is higher: 67% in Hong Kong, Singapore, and South Korea and 58% in Australia.

It can be challenges to analyze APAC as one regional block, and several questions emerge. Should the ten ASEAN[6] nations be treated as a sole entity? Or compare them to India and China, two giants that hog spotlight? Or group everything together with economies as Australia and New Zealand?

When attempting to comprehend APAC, the regional analysis conducted by Findexable[7] for Asia and the Pacific provide insight into some of these dynamics:

Despite regional nuances, APAC is home to one of the fastest-growing fintech industries in the world, and serves as the headquarters of numerous global and regional leaders, including: Ant Group, PineLabs, Phonepe, VoltBank, Grab, Policy Bazar, Judobank, WeLab, PayPay, CRED, Harmoney, and others.

There are 45 city-level fintech hubs among south, east, and west Asia and Australia, including Hong Kong, Singapore City, Sidney, New Delhi, Beijing, Tokyo, among others, where fintech is deployed to solve real-world problems. In developing economies, fintech is helping to unlock economic growth via increased financial inclusion, Vientam’s ZaloPay and MoMo, who enable mobile P2P payments for the unbanked, as examples.

In the wealthiest markets, they are providing better user experience and advanced capabilities to a population that has most of its financial demands solved. Here, fintech services are incremental, rather than revolutionary. Australia’s BNPL Afterpay (acquired by Stripe for $29 billion) and neobank Judo, are excellent examples.

Because of the diversity of opportunities, according to a recent report by Boston Consulting Group and QED Investors[8], APAC is expected to outpace the United States and become the world’s largest top fintech market by 2030 with a projected CAGR of 27%.

- Heated Competition: As more companies enter the fast-growing fintech industry, competition is fierce for market share. Especially in markets where fintech is unlocking economic growth and financial inclusion, such as Singapore, Indonesia and South Korea, fintechs such as Grab, Tokopedia Indonesia, and Coupang have intensified the competitive landscape.

- China’s fintechs to look globally: Since 2021, a number of China’s fintechs have begun to go abroad as a response to the more stringent regulations on local fintech activity and the more difficult environment (e.g. Alipay+Unified Payment). We expect this activity to continue, as Chinese fintechs target Brazil, Mexico, Africa and other growth markets.

- B2B fintechs and Payments expanding in Southeast Asia: B2B solutions have received increased attention in the Asia-Pacific area during the past year, such as Indonesia-based digital payments platform Xendit.

- WealthTechs bringing new experiences: Wealth management platforms for low-income consumers, such as Syfe and Endowus, both in Singapore, represent a growth area, as fintechs seek to bring more sophisticated solutions to the region’s underserved populations.

Global Lessons from Asia and the PacificWhile the rest of the global continues to experience sluggish GDP growth, APAC may have some useful lessons that can be applied elsewhere.

- APAC governments have been instrumental in encouraging the development of the fintech industry since early stages. To provide some examples, Asian countries were among the first to launch digital banking licenses to encourage the development of neobanks. Malaysia and Singapore also both have regulatory sandboxes that allow digital banks to extend services to pilot customer groups, before becoming fully regulated. Indonesia and Thailand, for example, approved a cross border QR payments initiative as part of an ASEAN Payment Connectivity initiative. As whole, the region serves as a best-in-class example of how fintech friendly regulation spurs innovation.

- UX and complementary services drive the rise of superapps. This context has led to the proliferation of neobanks and mobile wallets that have branched out to become either lending platforms or comprehensive financial superapps, including Line, Grab, Alipay and WeChat. Key elements driving the widespread acceptance of fintech services in APAC are improvements in the user experience, the speed with which funds may be accessed, and the availability of services from non-banking businesses. The global Buy Now Pay Later frenzy of 2021 and 2022 is only one example of how financial innovation is shaking up both developing and developed economies.

The Asia-Pacific region provides a fascinating case study for the global fintech industry from which to draw inspiration, as they work to revolutionise the way financial services are provided to the highly banked and underbanked alike. In future articles, we’ll delve deeper into this fascinating region and its vast opportunities for fintech and payments industry.