Our economy left behind the economic growth rates of around 8%-9% which had over the period 2003-2008. Roughly, Argentina's economy has slowed down since 2011 to these days, having decreased their rates of economic growth to a 2.9% for 2013 and went into recession in 2014 with a 0.5% GDP growth. Today, the economy is weak and the inflation is high.

In 2014, the inflation rate was over 30% for privates (and for some of them closer to 40%), and around a 25% for the official statistics. This context has generated a drop in household purchasing power (affected by the drop in real wages due to the acceleration of inflation). At the same time, inflationary pressures are constant as a consequence of the expansion of the money supply which has been expanded at an average annual rate of 25% since 2003 to date (mainly, because of the assistance of the Central Bank to the Treasury). In conclusion, a sharp drop in consumption and a sharp increase in public spending.

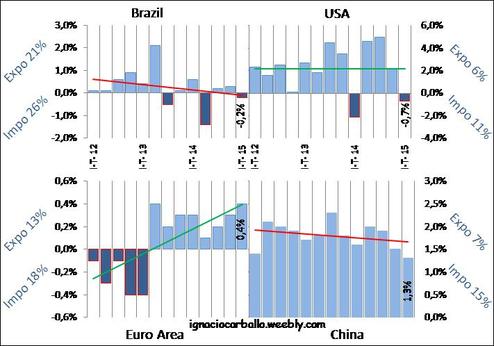

About the external situation, exports to Brazil (main trading partner, which buys more than a fifth of our exports) are being affected as a result of lean economic development in this country and the corresponding depreciation of its currency making more expensive foreign purchases as we mentioned here. In addition to this, the European Union (approximately 13% of our exports) and the United States (approx. 6%-7%) continue to show signs of recovery while China (approx. 7%) appears to slow it´s economic growth. The challenge in this regard is to boost export relations with new partners (or with the old ones that are growing again). And to reverse the deficit position in the trade balance with the four major partners (Either increase the quantities and diversification of exports.)

GDP quarterly performance of major trading partners and Argentine participation in international trade

Source: own calculations based on http://www.tradingeconomics.com/ and INDEC

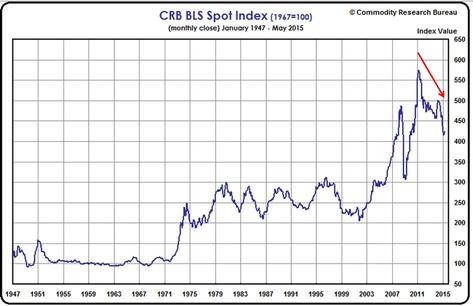

Sustained drop in commodity prices since 2011, accelerating from 2014

Source: http://www.crbtrader.com/

Looking ahead, major changes are not expected, at least until the elections in October. However, there are some threats and weaknesses which are a constant and must be reviewed by a future policy agenda. Regarding to this, we can mention: combat high inflation; regulate the assistance of the Central Bank and ANSES to the Treasury; get a budgetary policy wise, lax and with an efficient public expenditure; revert the inefficient investment in energy and transport; adjust the public subsidies; revert the fact that the State haven’t had access to international financial markets since 2001; and revert the (still) high dependence on the prices of agricultural commodities.

According to this, the post-elections agenda will remain intact and tasks will be waiting to be performed.